Inheriting property is often a bittersweet experience, intertwining the blessing of receiving such a significant asset with the painful loss of a loved one. During this profound transition in life, those entrusted with managing real estate held within a trust bear an immense responsibility. As a trustee, you must act with unwavering integrity, safeguarding the interests of the beneficiaries while strictly adhering to the trust's terms and relevant legal guidelines.

This comprehensive guide serves as a compassionate yet pragmatic roadmap, equipping you with the knowledge and strategies to confidently navigate the intricate process of inheriting, evaluating, and potentially selling property held in trust. It acknowledges the emotional weight of such a journey while providing practical direction.

Initial Steps

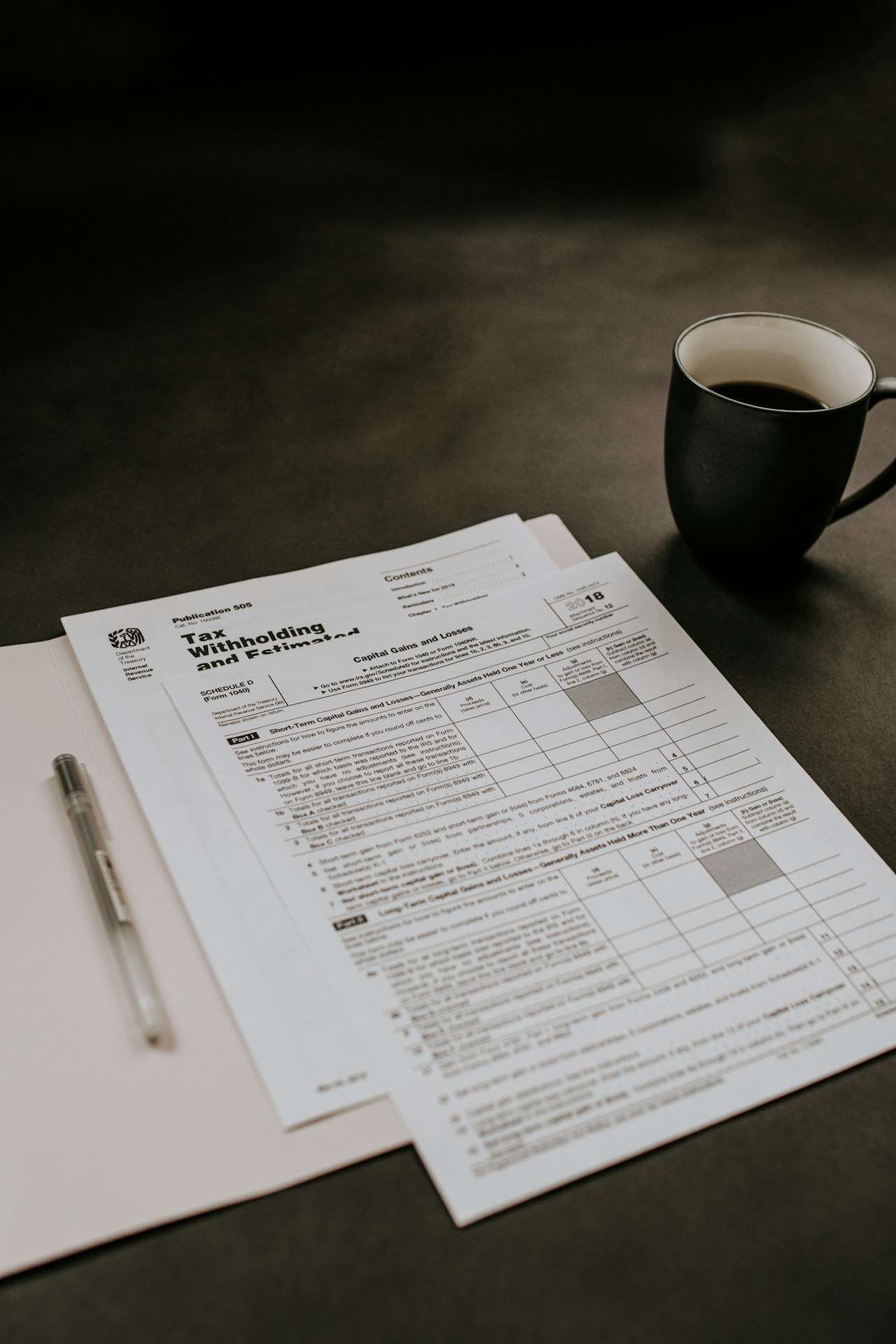

Upon a decedent's passing, obtaining a professional appraisal to establish the property's value at the time of death is crucial. This valuation informs tax implications and decisions regarding management or sale. Gather important documents like the death certificate, trust agreement, and any amendments to fully understand your powers and obligations as trustee.

Stakeholder Engagement

Notify all relevant parties, including beneficiaries, co-trustees, attorneys, and financial advisors, to ensure transparency. Promptly assess the property's condition, addressing maintenance needs and updating insurance coverage. Consult legal professionals specializing in trusts and estates to ensure compliance, and engage accountants to advise on tax strategies.

Trustee Coordination

If multiple trustees are involved, establish clear communication channels and decision-making processes through regular meetings. Coordinate with any named executor to align efforts in administering the estate efficiently.

Evaluating Property Sale

When considering selling the property, carefully evaluate whether this aligns with the trust's objectives, market conditions, and beneficiaries' long-term interests. Take the following steps:

- Engage an experienced real estate agent who can provide guidance tailored to trust sales.

- Provide all necessary documentation, including the trust agreement, death certificate, and appraisal.

- Work closely with accountants to minimize tax liabilities.

Conflict Resolution

In the event of disagreements among trustees regarding the property's fate, seek mediation or legal counsel to resolve conflicts while upholding your fiduciary duties.

Inheriting property held in trust is a profound responsibility laden with legal and emotional complexities. By diligently following this comprehensive guide and seeking professional expertise, you can navigate this journey with confidence, compassion, and adherence to your obligations as a trustee.